Client: Connecticut Roundtable on Climate and Jobs (CRCJ)

Authors: Jordan Burt, PhD, Elisabeth Seliga, and Joshua R. Castigliego

August 2025

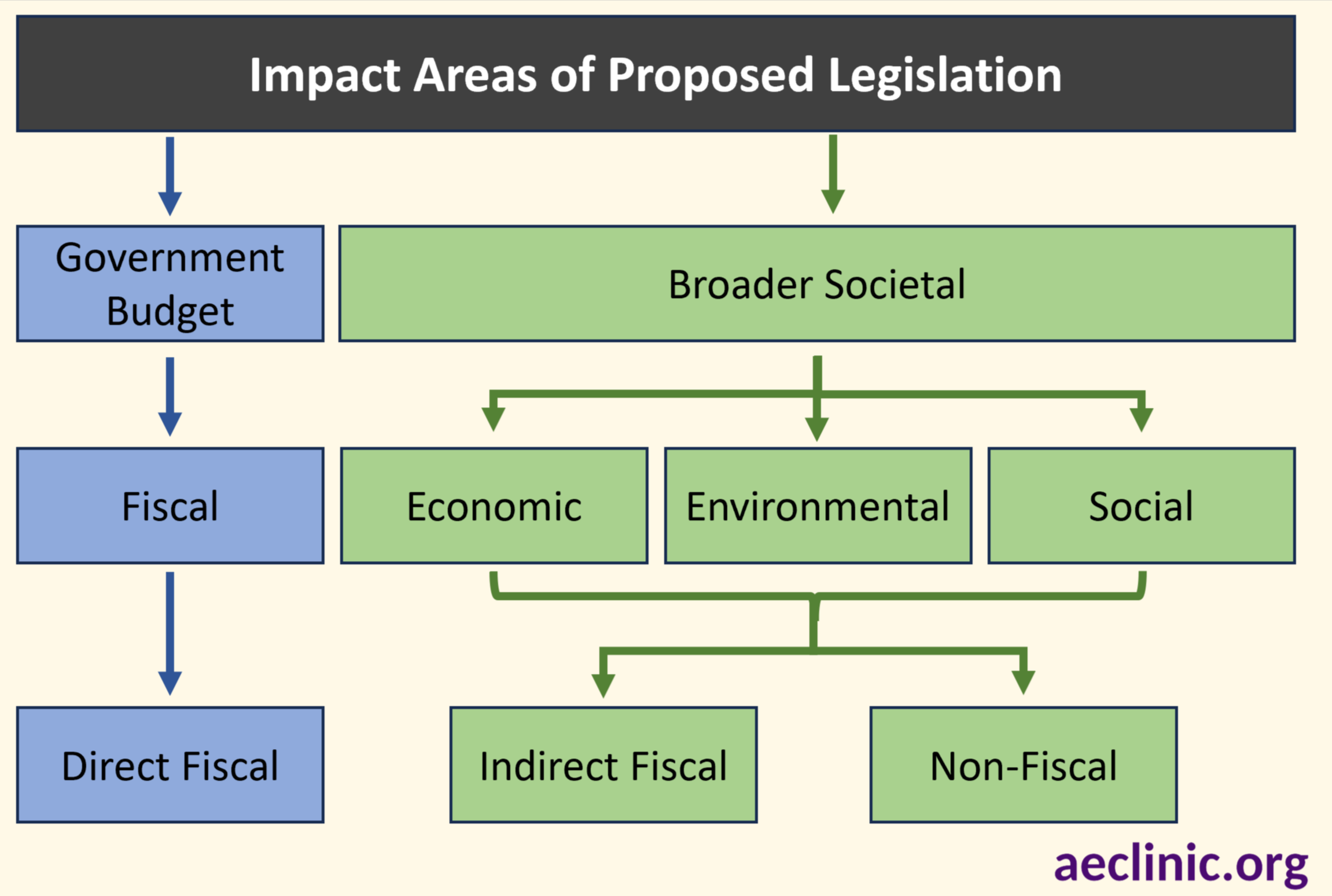

On behalf of the Connecticut Roundtable on Climate and Jobs (CRCJ), Researcher Jordan Burt, PhD, Assistant Researcher Elisabeth Seliga, and Senior Researcher Joshua R. Castigliego prepared a policy brief that evaluates the use of fiscal notes in Connecticut’s legislative review process and identifies the key limitations in capturing the full extent of a bill’s impact in Connecticut. Fiscal notes summarize the expected impacts on government revenues and expenditures, helping lawmakers evaluate a bill’s impact on government budgets. To best inform decision-making, fiscal notes must accurately reflect the true cost of legislation. In Connecticut, fiscal notes exclude indirect fiscal impacts. The result is a misestimation of a bill’s effect on the state’s budget that can result in beneficial proposals being rejected or flawed legislation being passed. As a first step toward improving the accuracy of fiscal notes, AEC recommends that Connecticut adopt “enhanced fiscal notes” that incorporate both direct and indirect fiscal costs to provide a more complete picture of a bill’s fiscal consequences during the legislative review process.