Source: Ng, K. 13 May 2025. “Minority Homeowners Face Disproportionate Climate Risks That Could Exacerbate Inequality”. Zillow. Available at: https://www.zillow.com/research/climate-risk-inequality-35122/.

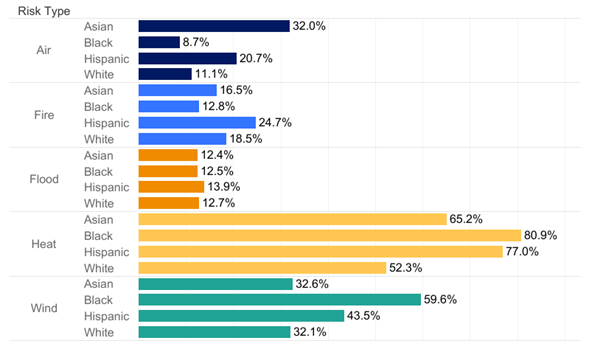

In the United States, people of color endure the greatest financial hardship from climate risk. For example, 81% of Black homeowners face the risk of extreme heat. These risks are reflected in residential real estate prices, as investors and owners apply higher risk premiums to areas vulnerable to climate disasters. The value of non-financial assets, such as housing, can be significantly reduced by climate change. Similarly, climate risk is incorporated into financial asset valuations. When climate change leads to rising sea levels or hurricanes, property values decline as risk is factored into pricing. Historically, after major climate disasters, access to credit becomes severely restricted, disproportionately affecting people of color, who are often unable to secure loans to evacuate, repair, or rebuild after severe weather events. Climate change damages also increase the likelihood of loan defaults, further lowering credit scores and deepening financial vulnerability. As a result, communities of color in high-risk areas bear the brunt of the widening wealth gap driven by climate change. Climate change comes with a price to pay, but the price for each payer is not equal.